REIT EQUITY SHARES

Farmland: A Valuable, Impactful Asset

Iroquois Valley gives investors access to a diversified portfolio of organic, regenerative farmland while directly supporting independent farmers with long-term land access. With a lower investment minimum, our offering is now open to both accredited and non-accredited investors.

Why Invest in Farmland?

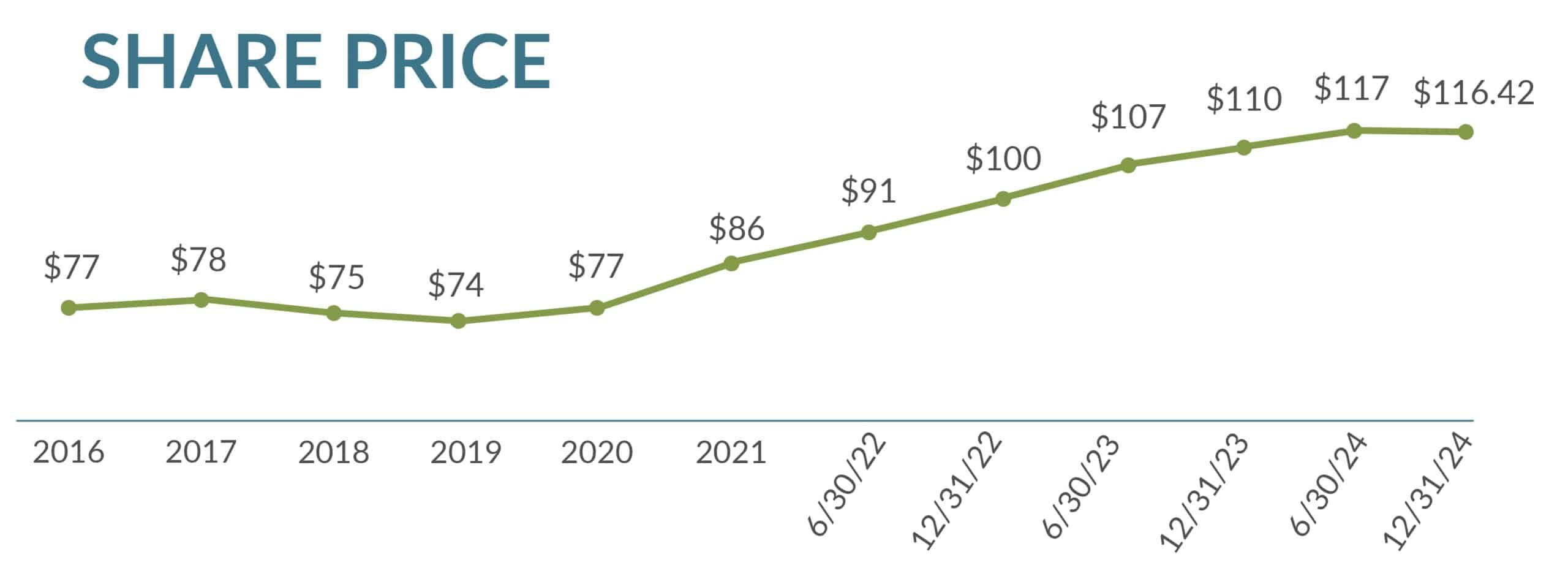

Organic farmland is a real asset that hedges against inflation and adds diversification, thanks to its low correlation with traditional markets. Our REIT’s value is primarily driven by steady land appreciation, and we also distribute annual dividends.

Sharing Risks and Rewards with Organic Farmers

Transitioning to USDA Certified Organic is a multi-year commitment. We structure our leases and mortgages to support this journey. Farmers pay a base rent tied to the land’s acquisition cost and, once certified, may pay variable rent when their revenues exceed a set threshold. This typically happens after organic certification, when crop prices and income rise.

Even then, farming comes with inherent risks—weather, for example. Our REIT’s dividend is linked to variable rent across the portfolio, meaning investors share in both the risks and rewards alongside our farmers.

Our REIT Equity Shares are available to investors across the U.S. and Canada

- Open to both accredited and non-accredited investors

(non-accredited investors may invest up to 10% of their annual income or net worth) - Minimum investment: $10,012

- 5-year minimum investment period

-

Liquidity through Iroquois Valley’s Redemption Program

- Eligible for self-directed IRAs and other tax-deferred accounts

- Shares may be held in brokerage accounts (restrictions may apply)

- Offered under SEC Regulation A+ (Tier 2)

REIT EQUITY SHARES

| ➤ Own stock in a diversified portfolio of organic, regenerative farmland | |

|---|---|

| ➤ Real asset diversification for investment portfolios | |

| ➤ Cash returns are based on a shared-risk model with organic farmers | |

| ➤ Accessible minimum investment: $10,012 $5,006 minimum for individuals under 35 |

|

| ➤ Available to both accredited and non-accredited investors | |

| ➤ Retail investor-friendly structure 5-year investment period before redemption rights accrue |

Complete the Investor Inquiry Form above to invest via the online portal or to speak with us about investing through an advisor or custodian.

|

Invest by Online Portal

|

Invest by Subscription Agreement

|

|

Invest Through Tax-Deferred Accounts (IRAs) Both REIT Equity Shares and Rooted in Regeneration Notes can be held in tax-advantaged accounts like IRAs and 401(k)s. |

Invest with an Advisor We work with a wide network of investment advisors nationwide.

|

Invest Through a Brokerage Account

Iroquois Valley REIT Equity Shares have been approved as an Alternative Investment by some traditional custodians, including Fidelity, Charles Schwab & Co. Inc., and Pershing. You may be able to hold shares in your brokerage account and see them reflected on your statement.

Interested in learning more? Reach out via our Investor Inquiry Form!

| Investment Guide | Download (pdf) |

|---|---|

| Offering Circular | Download (pdf) |

| Subscription Agreement | Download (pdf) |

| 2024 Audited Financials Statement | Download (pdf) |